- This investment is best for children. However, it is beneficial to invest at a young age.

- This plan is ideal to invest for higher education

- It is single premium policy where opting for Lumpsum or Installment Benefit both are good. ( Regular and Limited mode applicable.)

- This plan supports short term investment, where you can avail benefits later in life

- Get maturity through installments that help to fill the income gap in future

- Safe haven to park the profits from startups with guaranteed future returns

- Avail lumpsum maturity which helps to augment funds for future needs or business.

- This plan provides financial support to the family in case of unfortunate death of the life assured

- Increasing guaranteed income benefit option that helps to take care of fixed needs cost of which always keep escalating

- Excellent option to invest retirement proceeds like gratuity with guaranteed income benefit OR Lumpsum maturity which is helpful to fulfill old age commitments.

- It is a great alternative for bank deposits and is also the new version of FD with Guaranteed Returns and Life Cover

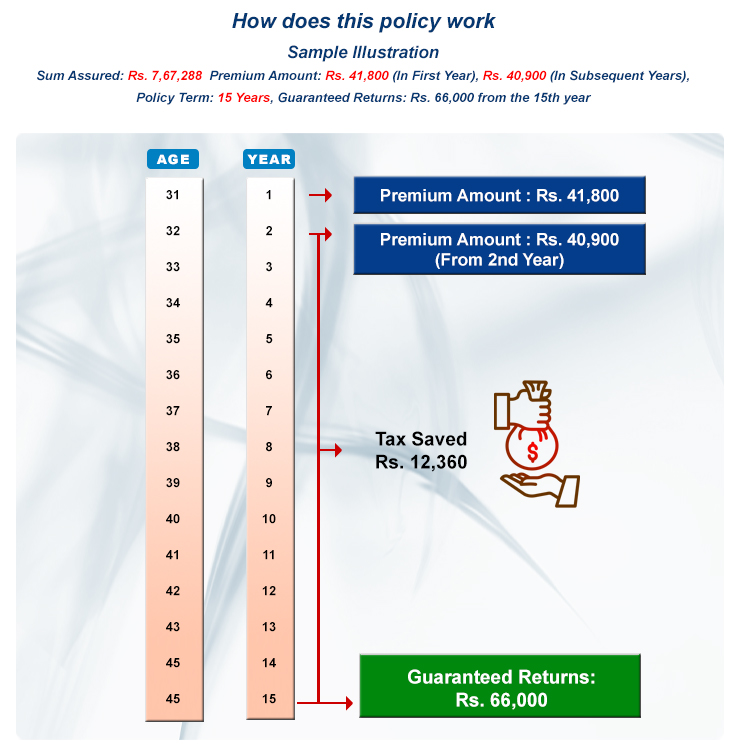

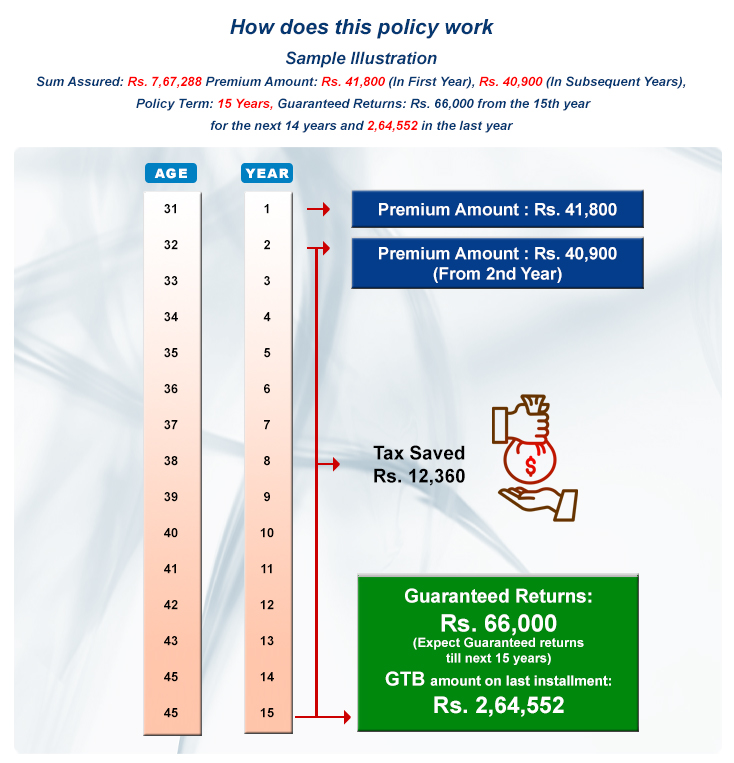

How Does This Policy Work

Sample illustration

| Eligibility Criteria |

| Minimum Entry Age |

3 years (completed) for policy term of 15 years |

| |

8 years (completed) for policy term of 10 years |

| |

13 years (completed) for policy term of 5 years |

| |

|

| Maximum Entry Age |

Option A & Option B : 50 Years (nearer birthday) |

| |

Option C: 65 Years (nearer birthday) |

| |

Option D: 40 Years (nearer birthday) |

| |

|

| Minimum Maturity Age |

18 Years (completed) |

| |

|

| Minimum Age at Maturity |

Option A & Option B: 65 Years (nearer birthday) |

<

| |

Option C: 80 Years (nearer birthday) |

| |

Option D: 55 Years (nearer birthday) |

| |

|

| Policy Term |

Option A & Option B : 10 & 15 Years |

| |

Option C & Option D: 5,10, & 15 Years |

| |

|

| Premium Paying Term (For Regular/ Limited Premium) |

5 & 10 years for 10 Year Policy Term |

| |

5, 10, & 15 years for 15 year policy Term |

| |

|

| Payout Period |

Option A & Option B: Equal to Premium Paying Term |

| |

Option C & Option D: Equal to Policy Term |

| |

|

| Minimum Annualized/ Single Premium |

Option A & Option B: Rs. 30,000 |

| |

Option C & Option D: Rs. 2,00,000 |

| |

|

| Maximum Premium |

No Limit |

| |

|

| Minimum Sum Assured on Death |

No Limit |

| |

|

|